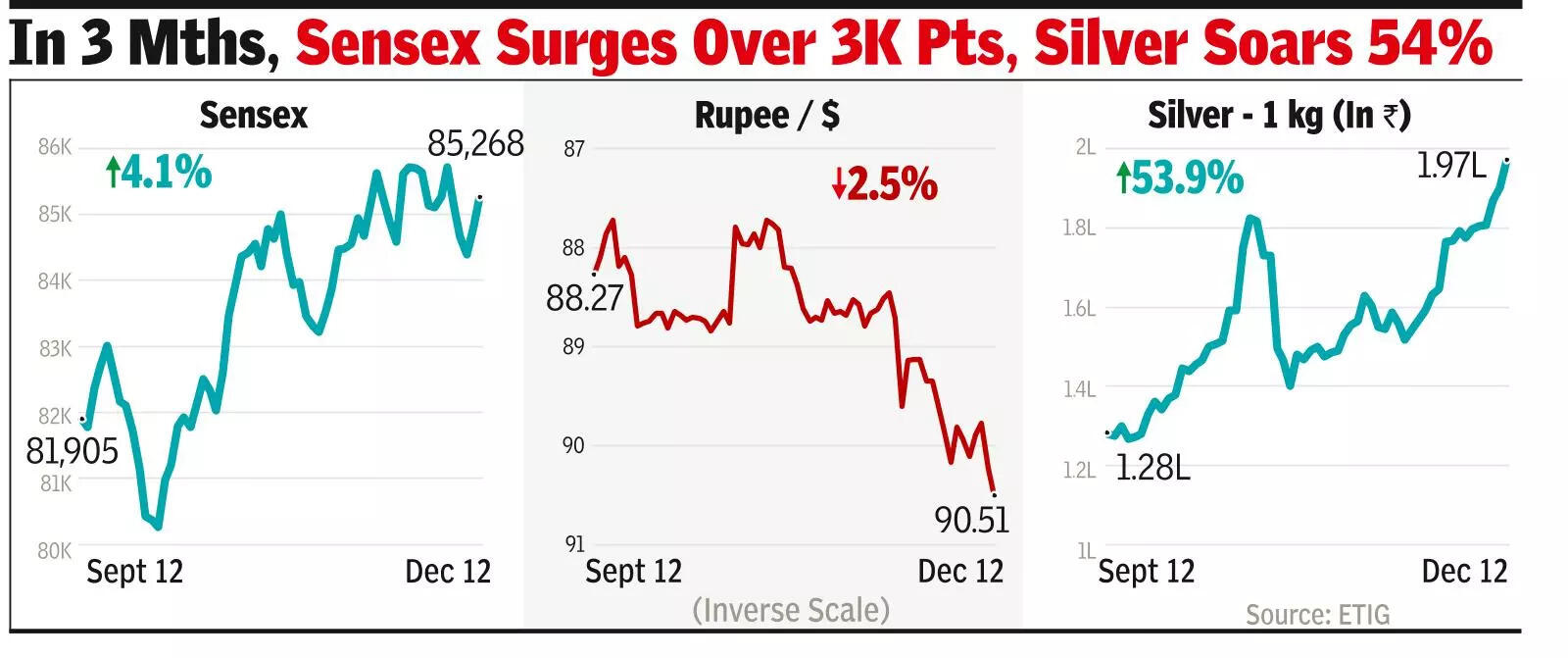

MUMBAI: A record-breaking rally on Wall Street on Thursday night, on the back of a quarter percentage point cut in interest rates by the US central bank the day before, boosted investor sentiment on Dalal Street on Friday that propelled sensex above the 85K mark again. At close, the sensex was up 450 points at 85,268 points with buying emerging across sectors. Nifty gained 148 points to close at 26,047 points.In the commodities market, silver broke above the Rs 2-lakh/kg mark on the MCX. And in the spot market, it was trading at a premium over the commodities exchange level. A report from Axis Direct on Friday said that Rs 2.4 lakh/kg level looks feasible in the coming year. Gold hit a new life-high mark globally at close to $4,400/ounce mark then suffered a sharp slide in late trades.

On Dalal Street, the day’s gains came on the back of strong domestic fund buying, at Rs 3,869 crore, data on BSE showed. In contrast, foreign funds were net sellers at Rs 1,114 crore. According to Vinod Nair of Geojit Investments, global risk appetite improved after the US Fed cut interest rates on Wednesday night, boosting liquidity optimism and lifting domestic equities despite the rupee hitting record lows and continued foreign fund outflows. “Broader indices are showing buying interest, bouncing back post recent consolidation,” Nair said in a note.The day’s rally added about Rs 3.7 lakh crore to investors’ wealth with BSE’s market cap at Rs 470.3 lakh crore. A sharp correction in late trades in international commodities markets, brought silver prices to below the Rs 2 lakh/kg level. This slide, however, could be temporary. The Axis report said that silver had broken out of a decade-long bottoming structure.“In the domestic market, any correction down to the Rs 1.7-1.78 lakh range can be used for staggered accumulation, with the target of around Rs 2.4 lakh for 2026,” the report said.