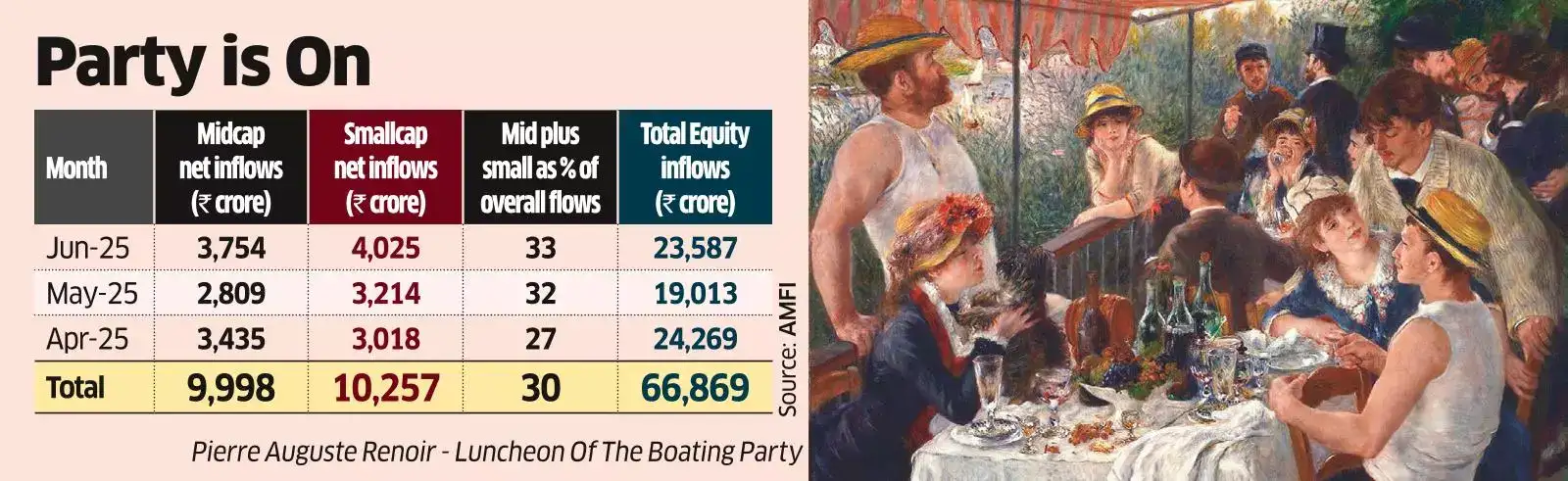

Retail investors are continuing to pour large sums into mid and smallcap mutual fund schemes, chasing high returns even as experts warn of stretched valuations and recommend a shift to safer ground.According to data from the Association of Mutual Funds in India (AMFI), investors allocated Rs 20,255 crore into mid and smallcap schemes in the first quarter of FY26—accounting for 30% of total equity inflows of Rs 66,689 crore during the period. Over the past 12 months, retail investments into these funds stood at Rs 90,075 crore, making up 23% of total equity flows of Rs 3.9 lakh crore, ET reported.“A lot of retail investors continue to chase past performance,” said Harshvardhan Roongta, principal financial planner at Roongta Securities. “Returns from mid and smallcap funds for three and five-year periods have been very high compared to large caps, which has kept investor interest intact.”According to Value Research data, midcap mutual funds have delivered 21.3% average returns over the past three years and 27.4% over five years. Smallcap funds did even better, with 21.94% returns over three years and 31.28% over five. In comparison, Nifty 50 returned 13.55% and 18.58% over the same periods.“Investors are looking to get exposure to some of the faster-growing segments of the economy, reflected in their preference towards midcap and smallcap funds,” said Dikshit Mittal, senior fund manager – equity, LIC Mutual Fund.ICICI Prudential Mutual Fund noted in its July outlook that both midcap and smallcap indices continue to trade at valuation multiples far higher than historical averages. While valuations have eased slightly since their September 2024 peaks, they remain elevated. The price-to-earnings (PE) ratio for the Nifty Smallcap 250 stands at 32 and Nifty Midcap 150 at 33.4—significantly higher than Nifty 50’s 21.7, ET report said.

A Whiteoak Capital study showed that while large caps currently trade at a 10% discount to their five-year average, midcaps are at a 14% premium and smallcaps at a 28% premium to long-term averages.Given this, wealth managers are urging caution. “Aggressive investors should allocate only 10–15% of their equity portfolio to the mid and small cap space,” said Vishal Dhawan, founder, Plan Ahead Wealth Advisors.Dhawan advised investors to stagger their investments through SIPs and maintain a long-term horizon of at least 10 years to avoid potential disappointment.(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)