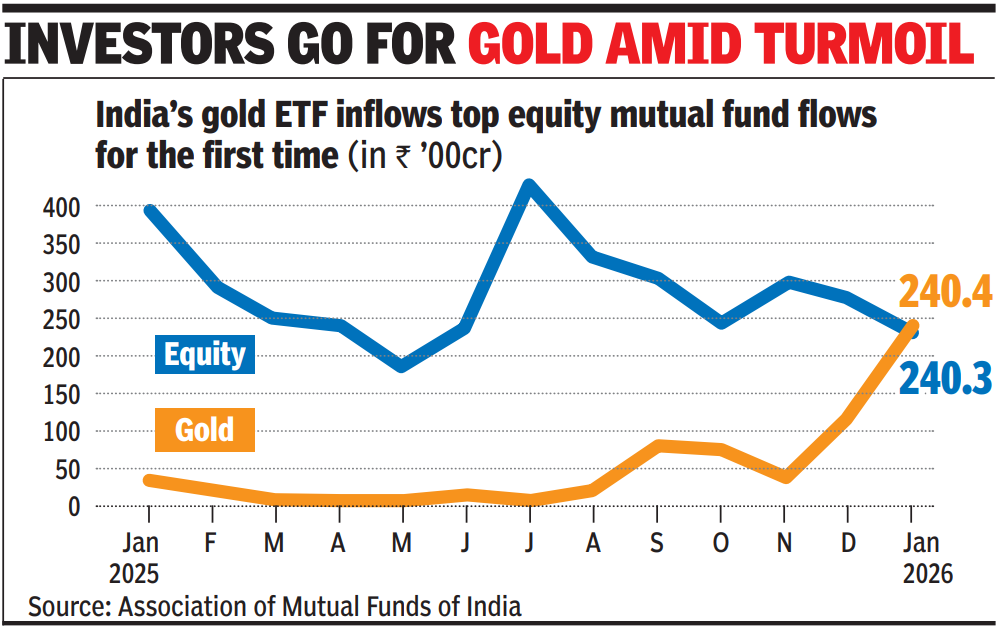

MUMBAI: Last month’s unprecedented rally in gold and silver helped net inflows into exchange traded funds (ETFs) for these two precious metals to outpace net inflows into equity funds for the first time ever. In Jan, compared to net inflows of about Rs 33,000 crore in gold and silver ETFs together, net inflows in equity schemes were at Rs 24,029 crore, a trait that one fund manager described as a proof of ‘performance chasing behaviour’.During the month, the industry’s total assets under management (AUM) crossed Rs 81 lakh crore. Also, the month’s gross inflows through systematic investment plans (SIPs) were at Rs 31,002 crore, barely changed from Dec 2025 figure but still a new all-time high, data released by fund industry trade body AMFI showed. Between Dec 31, 2025 and Jan 29, gold prices on the New York Commodity Exchange had rallied 23% or nearly by $1,000/ounce (Oz) to an all-time high of $5,586. However, the last day of the month had seen a dramatic 12% fall in just one session.The rally in silver was even more spectacular: From $70/Oz, it had rallied over 60% to $121 before closing the month at $84.

In the domestic market, compounded by the weak rupee, gold had rallied to around Rs 2 lakh/10 gram and silver Rs 4 lakh/kg levels, both all-time high figures.The rally in the two precious metals, more at a time when the equity market was showing volatility with a downward bias, prompted investors to pile on to gold and silver ETFs, industry players explained.“Performance chasing behaviour (was) clearly visible in AMFI data,” said Viraj Gandhi, CEO, Samco Mutual Fund. “Compared to their average collections over the preceding 12 months, gold and silver ETFs saw record inflows, and multi-asset schemes also saw this phenomenon,” Gandhi said.Of the Rs 33,000 crore net inflows into gold and silver ETFs, Rs 24,040 crore was through those schemes that invest in the yellow metal, AMFI data showed. The balance of about Rs 9,000 crore was through the ETFs through which invest in silver, industry players said.Late last month data released by Nippon Life MF, the biggest player in the gold and silver ETF space in the country in terms of AUM, showed that while ETFs on gold had total assets worth Rs 1.63 lakh crore, in schemes for silver the corresponding number was Rs 1.13 lakh crore. AMFI, which releases only gold ETF data separately and silver ETFs aggregated with other similar funds showed AUMs of Rs 1.84 lakh crore and Rs 10 lakh crore, respectively for Jan.