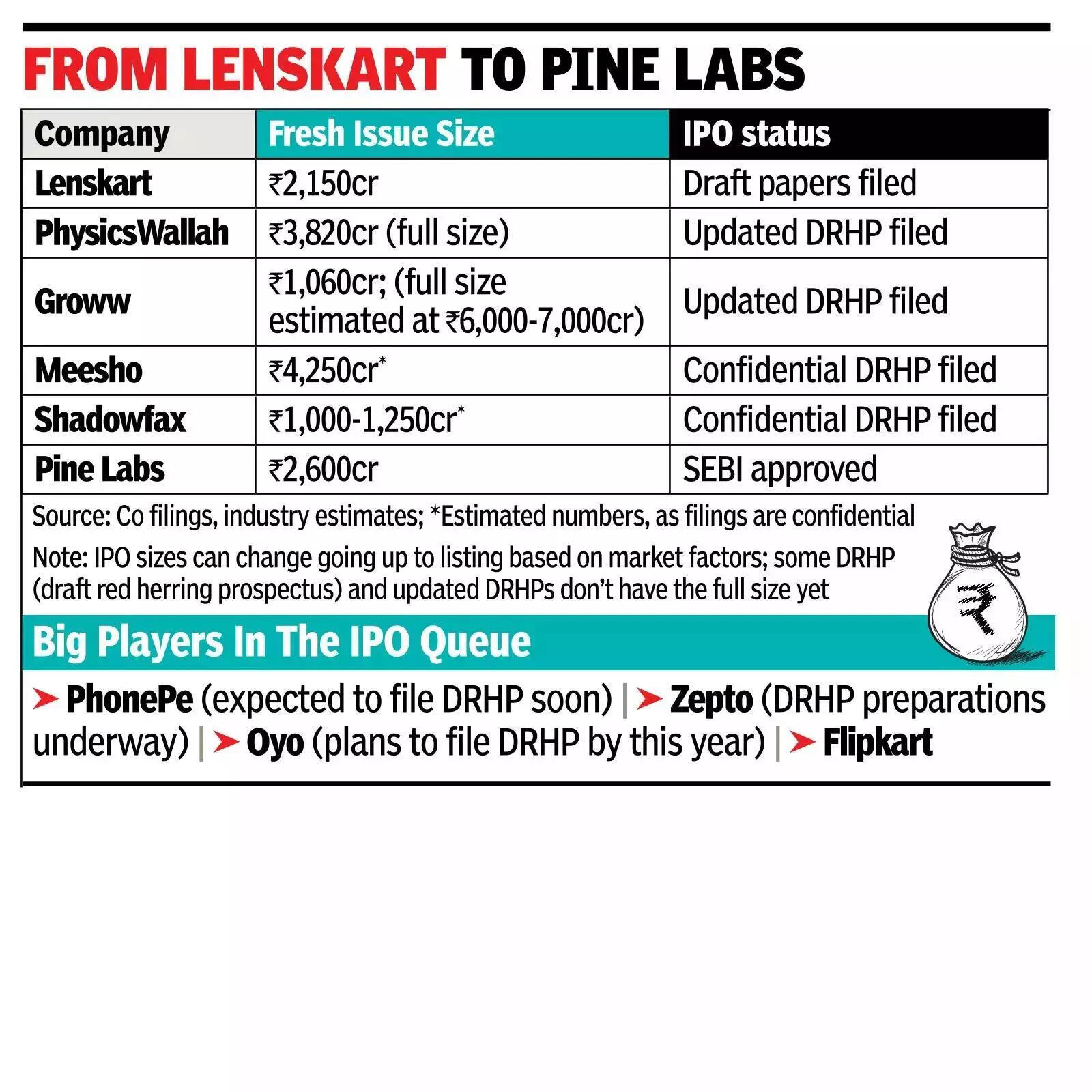

MUMBAI: After bouts of volatility, the IPO market seems to be gaining pace with a flurry of activity on startup street. Urban Company made a stellar debut on the bourses on Wednesday, setting the pace for more new-age listings.Pine Labs secured Sebi’s go ahead this week while companies such as Groww and Physicswallah are a step closer to a listing with the filing of updated IPO papers. There’s also a rush to file draft papers —PhonePe, sources said, is gearing up to file confidential IPO papers as early as next week with its eyes set on a billion-dollar listing. US-India trade talks will be closely tracked by investors, but if market momentum holds, it could be a cracker of a Diwali for new-age companies with potentially three to five startups getting listed in the late Oct-Nov period, investment bankers said. They added that new-age firms could raise about $2-$3.5 billion through IPOs in 2025, while some industry experts estimated the amounts to go even higher, upto $5 billion.

Filed IPO papers (not all are public yet) and industry estimates for 10 firms including Lenskart, Meesho and Groww alone showed that they are collectively seeking to raise over Rs 17,000 crore through fresh issuance of shares. “Domestic SIP inflows of Rs 28,265 crore in Aug are helping offset intermittent FPI risk-off while Sebi’s anchor reforms including a 40% allocation cap and participation by insurers and pensions are expected to deepen books and reduce execution friction for larger tech floats,” said Gaurav Sood, MD and head, equity capital markets at Avendus Capital.“India’s primary markets are running hot in 2025 with $8.5 billion already mobilised till now (overall size including OFS), and full year forecasts in the $23-$25 billion range across sectors,” Sood said. The overwhelming response to Urban Company’s blockbuster IPO debut — which was subscribed more than 100 times has boosted sentiment for startups planning public listings. Besides, markets regulator Sebi’s introduction of the confidential filing route and reduced lock-in periods have made going public less risky for startups, said Raghav Gupta, joint CEO at IIFL Capital.The overall IPO market has gained momentum with a dozen firms planning to get listed by the end of this month. “The DRHP filing activity continues to be strong as last three months have seen more than 60 DRHPs filed,” said Anurag Byas, director, equity markets solutions at Rothschild & Co.Not all startups that got Sebi approval will get listed this year; some could spill on to early next year, with market windows, valuation alignment and quarterly performance dictating their launches.