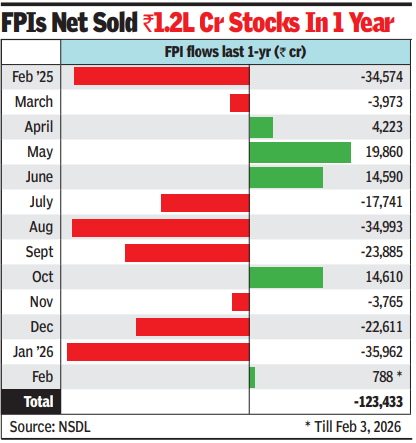

MUMBAI: The US-India trade deal is expected to have a positive impact on foreign fund buying in India, potentially reversing their massive outflow from the stock market witnessed in recent months.On one hand, the deal lifts a long-standing overhang from the market that in turn would improve investor sentiment about India globally. In addition, this could also strengthen the rupee, and combined with better corporate earnings, may attract foreign funds to invest in India in a major way again, top broking house official said.So far in 2026, foreign portfolio investors (FPIs) have net sold stocks worth nearly Rs 35,000 crore in the Indian market. This comes on top of the Rs 1.7 lakh crore worth of stocks net offloaded in 2025. The sell-off, in turn, put pressure on the rupee.

FPI flows last 1 year

Despite strong central govt intervention, the rupee had depreciated over 6% since the start of 2025. FPI selling in India also led to underperformance of the Indian market with Nifty up a modest 7.4% in the last one year to Feb 2 and sensex up 5.8%. In comparison, South Korea’s Kospi Composite more than doubled in value while Brazil returned 45%.“The underperformance of Indian equities over the past year can be traced, at least in part, to large and persistent FPI outflows,” said Sujan Hajra, chief economist & executive director, Anand Rathi Group. These flows were driven by rising geopolitical and policy uncertainty around India’s trade relationship with the US.“For global investors, deteriorating India–US relations translated into higher perceived risk premia, currency uncertainty and capital flight, even as domestic earnings held up.”“With the India–US treaty now in place, that overhang is beginning to lift. The key shift is not incremental tariff relief, but the restoration of geopolitical and trade stability. As risk premia normalise, India once again looks investable to global capital—a high-growth, politically aligned, strategically important economy with deep domestic demand and improving external linkages to both the US and Europe,” Hajra said. In Tuesday’s market, net inflow by FPIs was at Rs 5,236 crore, the biggest single-day inflow in three months, BSE data showed. Market players, however, feel that this could be an aberration but the direction of the flows are likely to change soon.