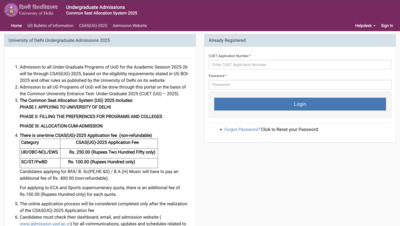

When the Trump administration signed its sweeping tax-and-spending bill on 4 July 2025, a quiet but consequential shift was tucked into its 700-plus pages. Amid the fanfare over tax cuts and spending reallocations, the Repayment Assistance Plan (RAP) was introduced as the new framework that will govern federal student loans from 1 July 2026. Marketed as a simplification of America’s complex income-driven repayment (IDR) system, RAP promises “legal compliance” after courts struck down parts of Biden’s student debt relief agenda. But scratch the surface, and RAP looks less like reform and more like a recalibration of who carries the weight of higher education costs in America.

From discretionary to gross income: Redrawing the fairness line

Under Biden’s Saving on a Valuable Education (SAVE) plan, repayment was tied to discretionary income—earnings above 225% of the federal poverty line, giving low-income borrowers breathing room. According to the Student Borrower Protection Center (SBPC), over 40% of SAVE borrowers earn less than this threshold (around $35,213 for a single person, $72,338 for a family of four), meaning many legally owed $0 monthly payments, with no interest piling up.RAP wipes out this buffer. Payments will now be based on gross income, not adjusted for essential living costs. A borrower earning $30,000 annually—once paying close to nothing—may see monthly bills rise to $100–$150, depending on Department of Education calculations. Supporters call this “shared responsibility”; critics call it regressive taxation disguised as reform, extracting more from those least able to pay while offering little relief to those already struggling.

A symbolic minimum payment, masking compounding debt

RAP introduces a mandatory $10 minimum payment for all borrowers, even for those with no verifiable income. The administration presents this as a fairness measure: every borrower must contribute “something.” Yet this token sum does little against loans accruing hundreds of dollars in interest monthly.Where SAVE paused unpaid interest to prevent balances from ballooning, RAP allows interest to compound without restraint. A borrower paying $10 on a loan generating $200 in monthly interest will see their debt grow, month after month, despite “repayment.” The minimum payment, far from ensuring fairness, ensures an ever-lengthening shadow of debt for the most vulnerable borrowers.

New borrowing limits and Pell Grant restrictions : The quiet gatekeepers

RAP is not just about repayment; it reshapes the entry point to higher education financing. The July 2025 bill introduces caps on federal loans, setting stricter annual and lifetime borrowing limits. Families whose tuition costs exceed these caps—common in graduate and professional programmes—will be pushed toward private lenders, with higher interest rates and fewer protections.Simultaneously, Pell Grant eligibility tightens, with new academic and enrolment criteria limiting who qualifies for this low-income student aid. While framed as fiscal prudence, the effect is clear: future students from disadvantaged backgrounds will have to borrow more from riskier sources or scale back their education plans, perpetuating inequality long before repayment even begins.

The legal pretext: Policy by injunction

The Department of Education has repeatedly justified RAP, and the recent interest accrual restart (effective 1 August 2025), as necessary compliance with federal court rulings that struck down SAVE. Yet, legal scholars and debt advocates note that no ruling mandated these specific policy shifts. Ending interest-free forbearance, replacing discretionary income formulas, or introducing minimum payments are choices, not obligations, presented under a veneer of judicial inevitability.This narrative of “our hands are tied” masks a deliberate policy direction: reducing federal liability for student loans, shifting risks back to borrowers, and signalling that higher education is increasingly a personal gamble, not a public investment.

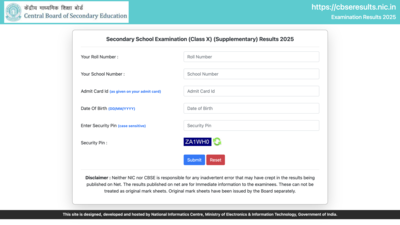

A more expensive, less forgiving future

For the 8 million borrowers currently in SAVE, interest is already accruing again, costing an estimated $300 per month or $3,500 per year on average, per SBPC data. When RAP kicks in from July 2026, these same borrowers could face higher mandatory payments, relentless interest growth, and fewer safety nets if their income falters.Future students will encounter tighter borrowing limits, reduced grants, and a repayment system less sensitive to their real ability to pay. In effect, RAP signals a policy retreat from income-driven protection, making the student debt system more rigid, more punitive, and less aligned with the principle that education should elevate, not impoverish.

The bottom line

RAP is sold as simplification and legality, but in practice, it reshapes the student loan system into a harsher, more market-driven regime. By moving from discretionary to gross income, introducing compulsory minimums, lifting interest safeguards, and constraining federal aid, it redraws the boundaries of opportunity in American higher education.For millions of borrowers—especially those below the poverty line—the promise of education as an accessible, upward path is narrowing, replaced by a reality where debt obligations harden even as economic security remains elusive. The legal justifications may soothe the policymakers’ conscience; they will do little to soften the arithmetic facing graduates in 2026.TOI Education is on WhatsApp now. Follow us here.