BENGALURU: Nearly seven in 10 CFOs exit within 24 months. The finance leadership role, once seen as stable, has become one of the most volatile positions in corporate India. More than 48% of CFO exits were triggered by mandate misalignment, where the scope of the role evolved after hiring or decision rights remained unclear, data from leadership advisory firm Ishwa Consulting, exclusively shared with TOI, showed. Around 31% left for career opportunities, while just 20% exited due to performance issues. The report tracked the tenures of 300 CFOs across listed and unlisted entities since 2020. “The churn isn’t about cost or capability; it’s about misaligned mandates and shifting expectations,” said Arvind Pandit, founder and managing partner at Ishwa Consulting. The pattern varies sharply across sectors. CFOs in infra and manufacturing average longer stints, over four years, while those in faster-moving sectors such as consumer, fintech, and tech sectors see higher churn. One in four exits across India Inc happens within the first year.

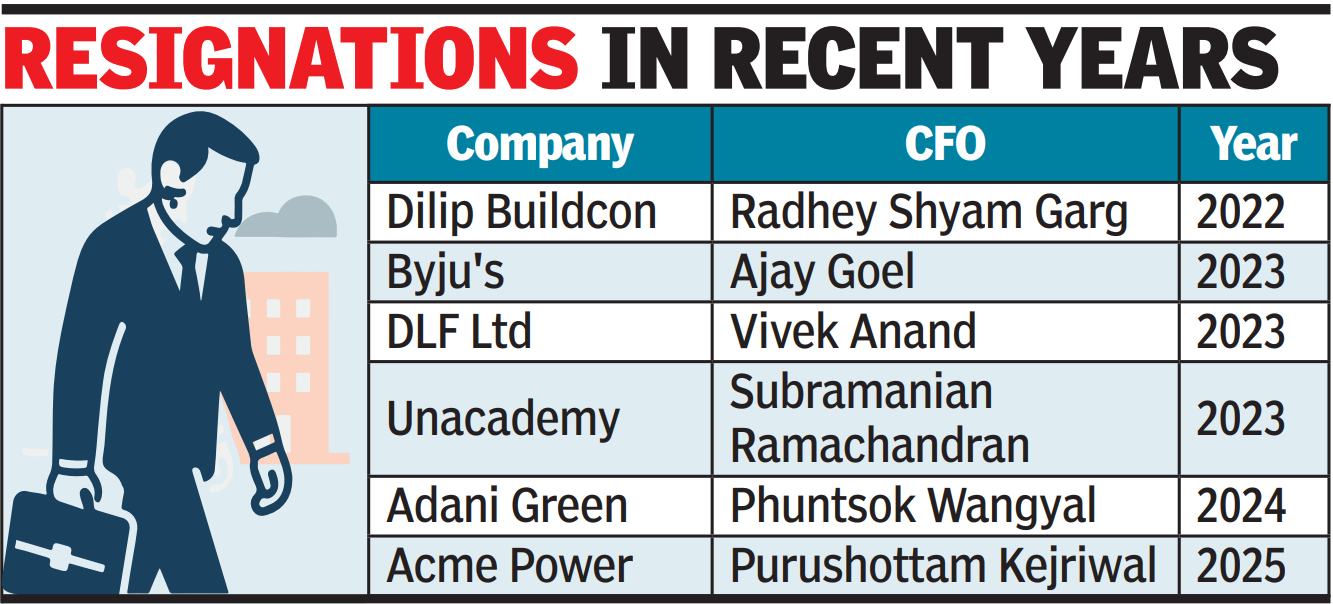

“Startups run on a treadmill,” Balakrishnan V, chairman of Exfinity Ventures and former Infosys CFO, told TOI. “CEOs are chasing capital and valuations while CFOs are grounded in operational reality. That friction is natural and explains why churn is far higher in younger companies, while established firms tend to see steadier partnerships between CEOs and CFOs.” IPO-related hiring adds to the volatility.Several large companies have seen high-profile CFO departures in recent years, underscoring the scale of the churn. These include listed firms such as Adani Green, Dilip Buildcon and DLF, as well as unlisted players like Acme Power, Arvind Smartspaces, Axis Bank, Byju’s and Unacademy.Ishwa’s data shows that 15-20% of CFOs were hired to prepare companies for listings, but nearly 60% of those hires left after IPO plans were delayed or shelved. Founders and boards often reassess such roles because the profile of an IPO-ready CFO – deeply connected to the banking world and capable of communicating with investors at the same level as a founder- comes at a premium. “You see this in leaders like Zomato’s Akshant Goyal, Swiggy’s Rahul Bothra, and Meesho’s Dhiresh Bansal,” said the founder of a late-stage company. “In early stages, CFOs focus on compliance and controls. But once a company prepares for the public markets, the role demands a very different skill set. If IPO timelines shift, boards are forced to revisit whether that investment still makes sense.” Retention hinges not just on market cycles but on how companies hire and integrate their CFOs.Ishwa’s data shows that internally promoted CFOs stay a median of 5 years, compared with just 1.7 years for external hires. Similarly, CFOs who rated their onboarding as ‘good’ stayed an average of 5.2 years, while those with poor onboarding lasted just 1.6 years. “What retains a CFO isn’t just pay,” said Balakrishnan. “It’s autonomy, clarity in decision rights, and the ability to deliver without being second-guessed. Legacy matters more than compensation.” When CFOs do leave, about 40% move to larger companies, 30% take up CFO roles at other startups, around 20% join PE-backed firms, and 11% transition to CEO roles – a sign of how the finance function has become a launchpad for broader leadership careers.