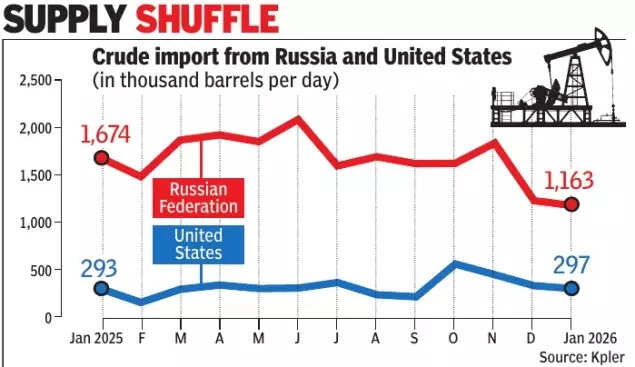

Days after India and the US announced a trade deal, the government has reportedly urged refiners to consider picking up more crude oil from the US and even Venezuela. US President Donald Trump has removed the 25% tariffs linked to India’s purchase of Russian crude, though as per the executive order the tariff may be reimposed if India doesn’t stop purchasing Russian crude.India on its part has said that the country’s energy security will drive purchase decisions, and diversification of crude oil basket and procurement at the best rates available in the international markets will determine its strategy.

More US, Venezuela oil to flow in?

According to a Bloomberg report, India has urged its state-run oil refiners to evaluate the possibility of increasing purchases of crude oil from the United States and Venezuela. According to refinery executives familiar with the discussions, companies have been encouraged to give preference to US crude grades when sourcing oil through spot market tenders. A similar suggestion has been made regarding Venezuelan crude, although such supplies are expected to be arranged through private negotiations with traders rather than open tenders, the Bloomberg report said.

However, practical constraints limit the scale at which Indian refiners can replace existing supplies with oil from the United States or Venezuela. US crude is typically light and sweet, meaning it has lower sulphur content, while many Indian refineries are configured to process medium-grade crude.Also Read | Trump removes 25% penal tariff: What happens if India stops buying Russian crude oil?Pricing considerations are also likely to influence decisions, particularly given the higher transportation costs associated with long-distance shipments of crude oil.The report said that industry executives have expressed concerns about the economic feasibility of significantly expanding imports from the United States in the near term, as higher freight expenses reduce the competitiveness of such shipments. Indian refiners also have access to relatively cheaper alternatives from regions such as West Africa and Kazakhstan, which benefit from shorter shipping routes.Refinery officials indicated that Indian processors could potentially import around 20 million tonnes of US crude annually. This is around 400,000 barrels per day. Even at that level, imports would be higher than last year’s volumes, when Kpler estimated daily purchases at about 225,000 barrels.Meanwhile, the Trump administration has appointed major trading firms Vitol Group and Trafigura Group to market Venezuelan crude after asserting control over the country’s energy sector earlier this year. Indian buyers have already acquired some cargoes, with state refiners including Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. recently purchasing around 4 million barrels of Venezuelan oil.Refinery executives said this volume is close to the maximum quantity of heavy, sour Venezuelan crude that state refiners are able to process each month, given existing technical limitations.