Finance minister Nirmala Sitharaman unveiled the Union Budget 2026 on February 1, setting out a clear roadmap for individual taxpayers. While personal income tax rates and the broader structure of taxation stays untouched, the Budget introduced a range of reforms to further simplify the process for taxpayers. The measures focus on easing return-filing timelines, reducing tax collection at source on select transactions, and addressing long-standing practical difficulties faced by small taxpayers. The Budget also had measures for foreign asset holders.The finance minister said that the government completed a comprehensive overhaul of the existing tax law and is preparing taxpayers for a smoother transition. “In July 2024, I announced a comprehensive review of the Income Tax Act, 1961. This was completed in a record time and the Income Tax Act, 2025 will come into effect from 1st April, 2026,” she said.

She added that compliance under the new framework is expected to be simpler. “The simplified Income Tax Rules and Forms will be notified shortly, giving adequate time to taxpayers to acquaint themselves with its requirements. The forms have been redesigned such that ordinary citizens can comply without difficulty,” Sitharaman said.

Here are top 10 things that individual taxpayers should know:

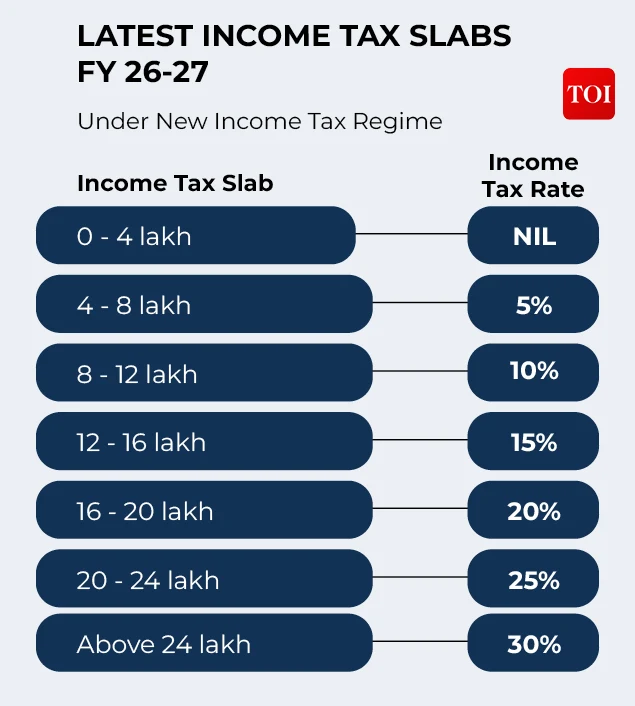

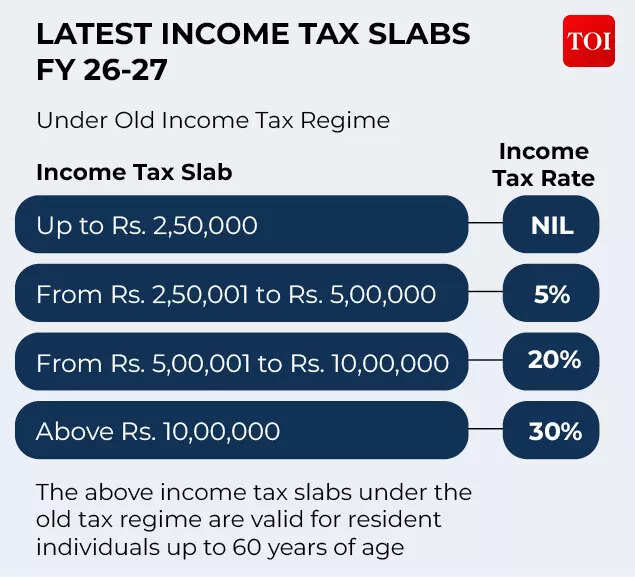

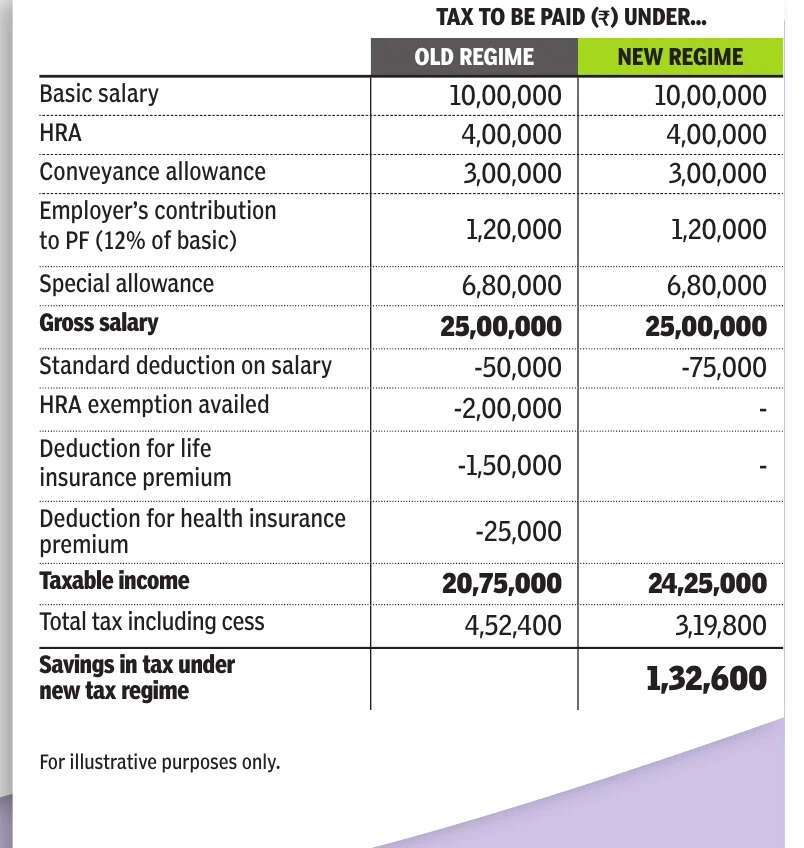

Same income tax ratesThe slab rates for individuals under both the new and old tax regimes will remain untouched in Budget 2026-2027. There are no proposed changes to education cess or surcharge either.

Change in timelines Filing timelines for returns have been revised. Individuals filing ITR-1 and ITR-2 will continue to have a deadline of July 31, while non-audit business cases and trusts will now be allowed to file returns up to August 31. The window for revising returns will also be extended from December 31 to March 31, subjected to payment of a nominal fee.Lower TCS Tax collected at source on overseas tour packages will be reduced to a flat 2%, replacing the earlier 5% and 20 percent rates, irrespective of the amount spent. TCS on remittances for self-funded foreign education and overseas medical treatment under the Liberalised Remittance Scheme will also be reduced from 5% to 2%. Measures for small taxpayersFor small taxpayers seeking nil or lower TDS certificates, a fully automated, rule-based approval mechanism will be introduced, replacing the current application-based process involving tax officers.Manpower segmentManpower services will now clearly fall under payments to contractors for TDS purposes, removing any confusion. TDS on these services will be charged at either 1% or 2%.DepositoriesTo simplify matters for taxpayers holding securities across multiple companies, the FM proposed depositories to be collected Form 15G or Form 15H from investors and submit it directly to the respective companies.Foreign assetsA one-time, six-month foreign asset disclosure scheme has been proposed to address issues faced by students, young professionals, tech employees and individuals relocating to or returning to India. The scheme covers two categories of taxpayers.

- Under Category A are taxpayers who failed to disclose overseas income or assets valued up to Rs 1 crore can regularise them by paying 30% of the fair market value of the asset or 30% of the undisclosed income as tax, along with an additional 30% in lieu of penalty, with immunity from prosecution.

- Category B will include taxpayers who paid due tax on overseas income but failed to declare the associated foreign asset, with asset value up to Rs 5 crore, can regularise it by paying a fee of Rs 1 lakh and receive immunity from both penalty and prosecution.

At the same time, individuals who did not disclose foreign non-immovable assets valued below Rs 20 lakh will receive immunity from prosecution, with retrospective effect from October 1, 2024.Changes for overseas investors and expertsPersons resident outside India will be permitted to invest in listed Indian equities through the Portfolio Investment Scheme, with the individual investment limit raised from 5% to 10% and the overall cap increased from 10% to 24%.

NRIs and assetsFor sale of immovable property involving non-residents, resident buyers can deduct and deposit tax deducted at source (TDS) using PAN-based challan, removing the need for a TAN and thus simplifying compliance.Global talentTo attract global expertise, an exemption on foreign-sourced income has been granted to experts visiting India for up to five years, subject to conditions. The individual must have been a non-resident for the preceding five years, provide services under a government-notified scheme and meet other prescribed requirements.